Understanding Current Cap Rate for Multi-Family Properties

Author: Tim Moegen

Author: Tim Moegen

November 30, 2022 - 3 MIN. READ

The current cap rate for multi-family properties is a vital metric for multi-family property owners to compare and determine the value of their real estate investments. According to Investopedia, the cap rate is found by taking a property’s net operating income and dividing it by its current market value.

Executive summary

This article aims to define the cap rate so property owners can understand the return on investment for their real estate holdings. This figure is crucial when determining when you can expect your investment will return a profit.

Capitalization rate defined

As described above, the cap rate for properties uses a simple equation to determine its value. To use this measure, real estate owners will need to have a complete understanding of their net operating income for a specific property. To define this figure, property owners will take their expected annual revenue and deduct all expenses incurred for that year. With this value, owners then divide that number by the current market valuation of their property. Fair market value is usually calculated by taking recent sales of comparable properties and using those numbers to produce an average. Once you divide these two values, you have the cap rate, which can be used to predict how many years it will take to recover a property’s initial investment.

It is important to note that estimated numbers are the basis of capitalization rates. Because of market variables, it is not a 100% accurate prediction. Despite the speculative nature of defining a property’s cap rate, when used with other supplemental data, it can show the risk an investor takes when acquiring a property.

Cap rate is most relevant for rental properties, but it does not always translate well for other real estate investments. The model used for the cap rate formula requires a property to have predictable, linear annual costs and expenses, as is the case with most rental properties.

Why capitalization rates are important

Ultimately, the current cap rate for multi-family properties is the most popular method of determining what you can expect regarding your property’s return on investment (ROI). It can provide an initial insight into the profit yield of an investment property relative to its total value, signaling whether a property is a promising investment or not.

Often, the seller will investigate the current cap rate for multi-family properties to appeal to investors by showing them the potential of the property on offer. For that reason, it is mutually important to both buyers and sellers when dealing in real estate.

What does your cap rate tell you?

After calculating the cap rate, you get a percentage. This percentage translates to the relative fraction of your property’s value that will be returned to you annually. Please see the example below:

Market Value: $1,000,000

Property Income: $100,000

Property Expense: $25,000

Net Operating Income: $100,000 - $25,000 = $75,000

Cap Rate: $75,000 / $1,000,000 = .075

.075 x 100 = 7.5%

In the above example, the property costs one million dollars. Expenses are subtracted from income to determine the net income to be $75,000. When dividing these values, we have a cap rate of 7.5%. For this example, investors can expect an overall annual return equal to 7.5% of their property’s overall value. Furthermore, if we divide 100 by this cap rate, we get the estimated number of years it will take to return the full value of one’s property. See below:

Cap Rate: 7.5%

100%/7.5% = 13.3 years to recoup total value of property.

As a rule, cap rates of 4%–10% represent a sound investment. Lower rates represent a slower return, but these are usually safer, more stable investments, while a higher cap rate yields a faster return but typically signals a riskier investment. However, relying on cap rate alone to determine the relative risk associated with investing in a certain rental property is not recommended, as future market fluctuations, changes in occupancy rates, and unexpected expenditures can all greatly affect your property’s ROI despite not factoring into previous cap rate calculations. According to CBRE, the average cap rate of multi-family properties was around 5.4%.

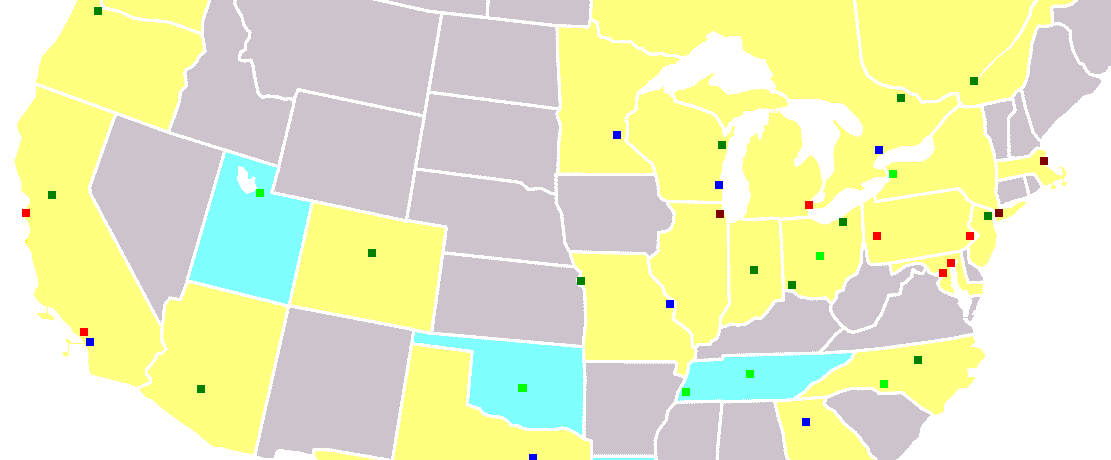

Property owners should be aware of two external factors used to help determine if a cap rate is sound or not: a property’s age and its location. For older properties, maintenance costs are higher than for newly built properties and should factor into the NOI (Net Operating Income). Location also plays a key role when purchasing a property, as cost of living, cost of doing business, property taxes, and demand can play a crucial role in your property’s overall value and should be considered. Because of these factors, a lower cap rate in one city may be as valuable as a higher cap rate in a less populated alternative.

Conclusion

Cap rate is a valuable tool for multi-family real estate investors. Especially for rental properties, the cap rate helps buyers understand how long it will take for their property to return a profit. Armed with an understanding of how the cap rate is determined and what it means, property owners will have greater control of risk management when investing in new properties.

Raiven can help

Many resources go into effectively managing multi-family buildings, and without a clear understanding of costs and profit, that effort could go to waste.

Raiven serves multifamily property owners and managers by providing the lowest prices on equipment, parts, and maintenance supplies as well as a purchasing platform that makes buying fast and efficient. Key benefits include:

- Pre-negotiated discounts of 7-25%+ from big name suppliers like Ferguson, HD Supply, Grainger, Graybar, Office Depot, and more.

- Supply chain alerts for price and product availability changes on the items that matter to you most.

- Private marketplace houses all your preferred suppliers in one location for easy access to your discounts. No more bouncing around websites comparing prices.

- AI-powered purchasing tools that find the lowest prices even when employees shop outside your network.

Raiven is your one stop shop to save time and money. Ask our clients Core Realty, Lyon Living, or Oaks Property Management what we have done for them. Visit Raiven to learn what we can do for you.

If you need your EV (Electric Vehicle) charging stations installed, be sure to visit Qmerit, the nationwide leader in electrification solutions.

Article Sources:

- https://www.investopedia.com/terms/c/capitalizationrate.asp

- https://www.bankrate.com/real-estate/fair-market-value/

- https://www.cbre.com/insights/reports/cap-rate-survey-h2-2021